The Coronavirus pandemic most likely affected overall investment activity in the insurtech space. But it may be too early to tell what long-term impact COVID-19 might have on the global community.

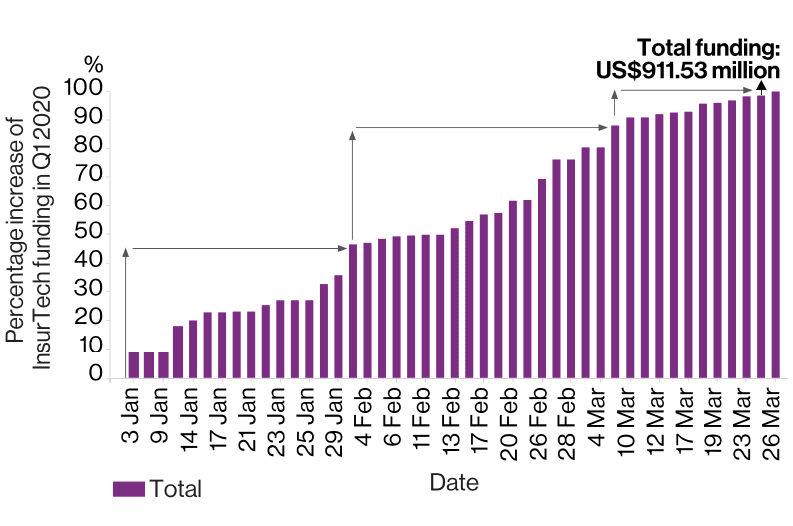

According to Willis Towers Watson’s Quarterly InsurTech Briefing, more insurtech deals were completed in the first quarter, compared with the year-earlier period, but overall funding declined 54% to $912 million amid the coronavirus pandemic.

The report stated that “it would be very easy to suggest that this is the beginning of the downward slope.” Does this mean that software solutions for insurance industry are under attack as well? Let's start from the very beginning.

Source. Running total of funding decelerates/Total funding: US$911.53 million

The use of chatbots within the insurance industry goes back over ten years: chatbot Hanna has been “working” for the Swedish Social Insurance Agency since 2003 by providing customer service, directing website visitors, and giving them information on social insurance.

Allianz Australia has its agent named Allie, and Canadian firm RBC Insurance has Arbie, a blue-suited, hat-wearing character with simple chat capabilities that rely on frequently asked questions. Similarly, Nienke helps customers navigate through Dutch insurance firm Nationale-Nederlanden’s (NN)’s website.

These chatbots, however, are relatively basic in terms of functionality. They represent the first generation of what ex-Uber and ex-Google engineer Chris Messina calls “conversational commerce.”

With advances in artificial intelligence and natural language processing, chatbots have come a long way since the first commercial chatbots arrived on the scene. US auto insurance company Geico, which has a customer base of over 14 million, has a new intelligent agent named Kate who is available within their iOS and Android apps; customers can type or speak to initiate a conversation with her.

“Interactive voice assistant technology has altered the way customers interact with their mobile devices. Kate is very intuitive and has been programmed to connect with policyholders at a deeper level,” says Pete Meoli, GEICO mobile, and digital experience director.

This more complex and yet more accessible version of a chatbot, which is voice-activated and lives within a mobile-app, may soon become the industry standard. In a Medium post, Messina said that over time “computer-driven bots will become more human-feeling, to the point where the user can’t detect the difference and will interact with either human agent or computer bot in roughly the same interaction paradigm”.

Mobile and Voice Will Push Chatbots Into Mainstream

The language of conversation rather than traditional computing interfaces, says Chris Messina, is more comprehensible to a broader audience, “which will, in turn, accelerate the adoption of conversational agents faster than we saw with desktop apps.”

Microsoft CEO Satya Nadella has also spoken about how the future of chatbots is tied to the future of fintech, specifically the insurance industry.

Ex-Apple CEO John Sculley has thrown his hat into the commercial chatbot ring. Finance companies should “plan for radical change or prepare for obsolescence,” which applies to those in insurance tech, or insurtech, as much as the rest of the fintech sector.

Ready to build a conversational bot for your business, but confused with the variety of platforms? Let’s talk!

Embracing Facebook Messenger: Insurance Chatbots Should Follow the Customer

Consumer adoption of insurance chatbots is key to their success and this will happen organically as insurance companies move their chatbots to where conversations are already being held. Messaging platforms like WhatsApp and Messenger (both owned by Facebook) are going to be major facilitators for these kinds of commercial opportunities as they open up to third-party chatbots. Already Messenger (in the US) has Uber integration so that users can hail a taxi inside a conversation they’re having with a friend about meeting up for food. This kind of scenario transfers easily to the insurance industry where friends are planning a trip abroad and can pull in a quote for travel insurance alongside creating their list of must-see tourist spots.

One major factor that will push conversational commerce forward for Facebook Messenger commercial partners is the ability to carry out financial transactions. Friend-to-friend payment functionality within Messenger has been around in the US for some time – it was introduced in March 2015 – but has yet to arrive in Europe. However, Facebook secured an e-money license from the Central Bank of Ireland in October 2016, which opens the door to the fintech industry to start a (chatbot) conversation with their customers where they are most at home.

Additionally, Facebook announced that the company has been working with big league payments players, including Stripe, PayPal, MasterCard, Visa, American Express, and Braintree.

A policy change in relation to chatbots has also opened up this platform for more flexibility in relation to financial transactions: the restriction on promotional content was removed, thus allowing businesses to use Messenger chatbots to send ads, special offers and other promotional messages directly to customers.

Subscription messaging was introduced, which has given businesses another way to get regular updates directly to the customer and effectively replace email in a way that ads or posts across social media currently fails to. This messaging is limited to three categories, including personal trackers or bots that enable people to receive and monitor information about themselves in categories that, significantly, include finance.

These kinds of chatbots are desirable for customers because it places them in control: the end-user must initiate the conversation with a business chatbot, and they can mute or block the bot at any time.

What’s in it for the average insurance company? A potential customer base from over one billion monthly active Messenger users and the ability to engage in media-rich ways that appeal to millennials i.e., using GIFs, buttons, stickers, menus, and so on. Dashbot reports that 44% of Facebook bots receive (mostly emoticon-based) stickers from users, while 14.5 percent of these chatbots receive animated images.

Additionally, WhatsApp announced that it would begin testing tools to allow users to communicate with relevant businesses and organizations: “That could mean communicating with your bank about whether a recent transaction was fraudulent, or with an airline about a delayed flight. We all get these messages elsewhere today — through text messages and phone calls — so we want to test new tools to make this easier to do on WhatsApp.”

A Burgeoning Ecosystem of Insurance Chatbot Startups

There are also dedicated firms working exclusively in this space i.e., working on chatbots tailored solely to the insurance industry. And they are not only beneficial to the customer-facing side of the industry: UK tech firm Nuance has developed a chatbot Nina “designed to deliver an intuitive, automated experience for all your digital channels by engaging your customers in natural conversations using voice or text.” Working with financial services company LV=, Nuance has created aLVin, a virtual assistant that talks to brokers, giving them the information they need at any time of the day, seven days a week.

London-based SPIXII created chatbots for insurance firms to use with their client base. Their app is an automated insurance agent labeling itself as “the chatbot that is making insurance approachable.” It was designed by a multidisciplinary team of experts in insurance, actuarial science, underwriting, data science, and high-performance computing.

The SPIXII app is smart in that it integrates with other apps on your smartphone and will be able to infer that you are traveling abroad, browsing for a new laptop, or about to engage in some high-octane sports, all things that might require insurance. The conversation is not only conversational; it is contextual, personally tailored, and relevant to the end-user.

As more millennials enter the workplace, they will require home, travel, car, and health insurance. Chatbots may be the ideal way to engage younger consumers about their insurance needs. In fact, chatbots may also be ideal in reaching those falling into the Generation X category. It was found that half of all internet users in the US aged between 18 and 55 have interacted with a chatbot with 11% and 15% of millennials and Generation Xers saying that they use chatbots all the time.

Summary

Chatbots, or conversational interfaces enabled by artificial intelligence, are a growth market – and for a good reason. According to US firm Transparency Market Research, the global chatbot market anticipated reaching US$ 2,358.2 million by 2027.

Ready to build a conversational bot for your business, but confused with the variety of platforms? Let’s talk!

The take-home message for the insurtech industry is that chatbots represent a growing opportunity to reach a wide market segment, but the focus must remain on mobile, and insurance chatbots must be willing to meet users on their home turf — Messenger, Skype or WhatsApp — while adapting to the increasing use of voice-activated interactions.