The insurance industry includes companies that suggest risk management in the form of insurance contracts. As customer preferences change impetuously, insurance companies are now required to adapt to the new-age consumer’s conscious, demanding, and informed needs. Deloitte has explored these changes in customer expectations.

But how well do insurers personally know their customers? Are they aware of the lifestyle that most of their clients lead? Do they know how often their clients activate the alarm when they go somewhere?

If insurance providers want to keep their customers, they have to understand their actions and needs better and use them to provide more regular and valuable interactions.

Journey to Personalization and Agility

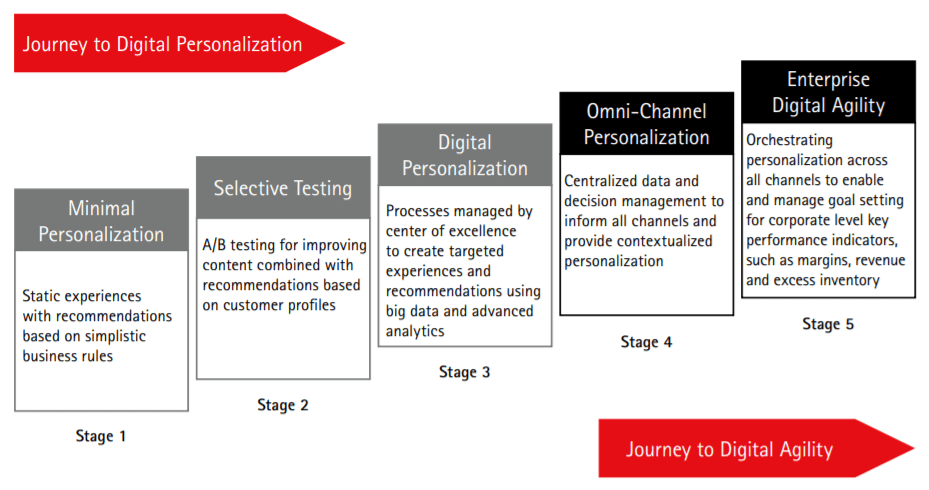

Nowadays, insurance customers need to get personalized and convenient service. Clients from different countries need personal interactions even if creating personalized experiences is difficult for insurers as it is connected with precise customer data. Here is the infographic illustrating the main steps of the personalization journey:

Source: Accenture

For example, one of the McKinsey articles has discovered insurance in China, where only 28 percent of customers rated insurance companies highly for customer satisfaction. It means that the insurance industry needs to accept some modifications. So what is the solution to this situation?

Benefits of Providing Personalized Customer Experience

Companies use personalization to deliver better customer experiences, increase loyalty, and drive more leads. Modern service provides a variety of channels that reflect customers’ various preferences and personalized recommendations based on individual interests.

Ways for Insurers to Personalize Their Services

Insurers can utilize segment-specific opportunities to personalize offers, messages, and prices across physical locations, mobile devices, mobile apps, websites, or phone calls. This way contributes to the formation of precise and actionable customer microsegments. It is also necessary to create a continuous ring of customer interactions because they provide protection and services for their daily life.

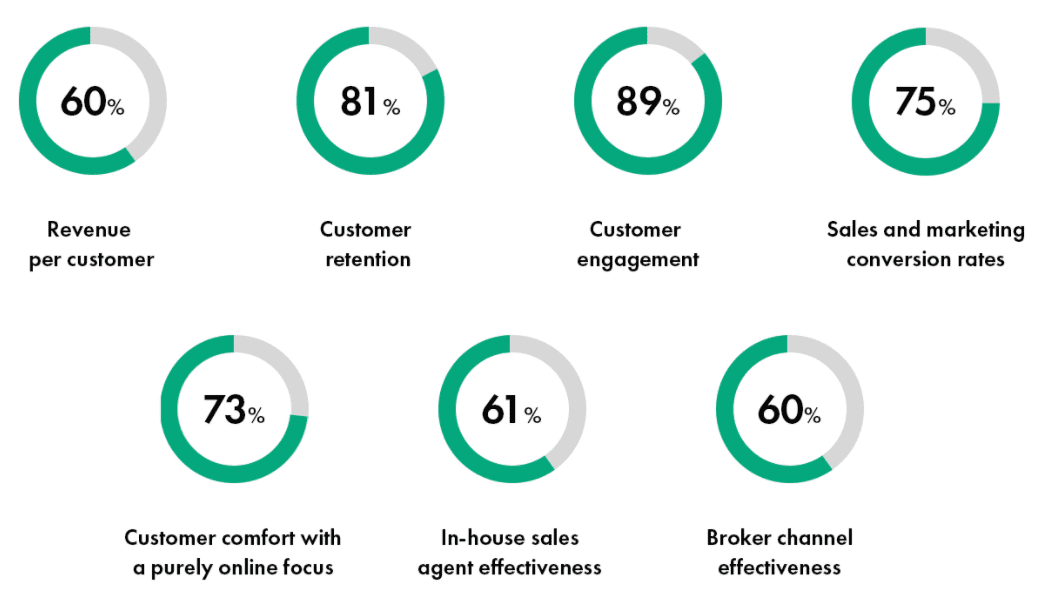

Companies, who are already offering advanced personalization, have noticed positive increases in the following areas:

Source: Earnix

Ensuring Highly Relevant and Omni-Channel Customer Experience

Today's consumers are mostly omnichannel. That`s why insurers have to engage their clients using an omnichannel approach, connecting with them via multiple touchpoints and using data to deliver personalized experiences.

Omni-channel personalization can upgrade customer experience and increase brand loyalty. It allows the insurer to preserve its competitive power, retain its customers and simplify growth. Implementing omnichannel personalization can be a complicated process, and it is not only about organizational alignment and strategy but also about technology.

Digitization Increases the Level of Personalization in the Insurance Industry

What can we say about digitization? Technology is making our experiences online more personalized. New data sources are transforming our economy and society essentially and promise to change the insurance software development services as well as the whole sector. Digitalization affects the role of insurance, from pure risk protection to predicting and preventing risks.

Insurance is becoming more customer-centric. Customers use digital channels, especially mobile, and this tendency is rising rapidly.

Insurers have the opportunity to leverage the information from various devices to satisfy customer needs across three broad themes: loss prevention and protection, pricing and coverage optimization, and some other services.

Every step of the insurance value chain will be impacted by digitization, from interactions with customers to claims management. For instance, by monitoring different situations, insurance companies can warn customers about a problem and allow them to react immediately to prevent damages.

Perspective, digital insurers will be able to provide services that will help reduce the risk of loss. These services can be connected with auto services such as driving-condition information, recommending safer routes, alerting emergency services, and monitoring automobile speeds. Services personalize recommendations tailored to the weather, a customer’s location, mood, health, and even bank balance.

Final Word

As a conclusion to this, we would like to say that customer preferences and market indicators show that clients have a desire to get personalized offers and experiences from their providers. Faced with high customer expectations, insurers are following the example of other industries in delivering an excellent customer experience through different channels. Besides, the digitization of the insurance industry also has the potential to grow exponentially.

At Intellectsoft, we empower companies and their workforces with innovative services and approaches to help them survive during these times. Are you and your organization looking for some?

Talk to our experts and find out more about the topic and how your business or project can start benefiting from it today.